workers comp taxes for employers

A Workers Compensation Insurance Company. Workers Compensation Mileage Reimbursement Notice.

5 Requirements For Workers Compensation Eligibility

I always try to write something on premiums being viewed as a tax this time of year.

. The postman just picked up all of our tax forms whew. The Ohio Bureau of Workers Compensation OBWC or BWC provides medical and compensation benefits for work-related injuries diseases and deaths. The ETT rate is 01 percent 001 and is paid like UI on the first 7000 in wages.

Even when the employer gives the employee freedom of action the person performing the. For married filing separate returns the amount is increased to 5250 previously 2500. However you can also claim a tax credit of up to 54 a max of 378.

One of the silver linings of a workplace injury is state and federal taxes dont apply so theres no wincing as you look at your pay stub and see where Uncle Sam took 20 or 30 off the top. In addition to the FAQs below employers may call 1-800-736-7401 to hear recorded information on a variety of workers compensation topics 24 hours a day. The main consideration is how the employer views the payouts.

Both employers and employees are responsible for payroll taxes. For 2021 the amount is increased to 10500 previously 5000. Employers can typically claim the full credit as long as their unemployment taxes are paid in full and on time.

For over a century weve been providing Americas small businesses with cost-effective workers compensation insuranceWith our emphasis on financial stability and fast efficient claims service we now serve clients in 46 states and the District of ColumbiaEMPLOYERS remains focused on keeping Americas Main Street. The employer will provide the injured employee a Workers Compensation Claim Form DWC 1 Notice of Potential Eligibility e3301 form to describe how when. Employers are required to withhold tax whether or not their employees are Oregon residents.

Do You Have to Pay Taxes on Workers Comp Benefits. Employers may not have to withhold tax on Oregon employees if they can prove that each employee will receive 300 or less within a calendar year. The new employer rate is 34 percent 034 for a period of two to three years.

When Is Workers Compensation Taxable. If you have any questions regarding the employees work requirements please contact employees manager at telephone. Workers compensation fraud is a serious crime that can strain business operations lead to higher insurance costs for businesses and even undermine honest workers who are legitimately injured on the job said Ranney Pageler vice president of fraud investigations at EMPLOYERS.

Eligible for workers compensation insurance coverage under House Bill 3618 2010. Many diseases may have both work and non-work causes. Employers may also call a local office of the state Division of Workers Compensation DWC and speak to the Information and Assistance Unit for help during regular business hours.

Diseases have historically been very difficult to cover under workers compensation because of causation requirements. Work locations include job sites office locations sales territories or an employees home. The Kansas Department of Labor provides workers and employers with information and services that are accurate and timely efficient and effective fair and impartial.

An employee is anyone who performs services for pay for another person or organization under the direction and control of the person or organization. The quick answer is that generally workers compensation benefits are not taxable. WHO IS AN EMPLOYEE.

The UI tax rate for experienced employers varies based on each employers experience and the balance in the UI Fund. The American Rescue Plan Act of 2021 increased the maximum amount that can be excluded from an employees income through a dependent care assistance program. The UI rate and taxable wage limit may change each year.

Questions pertaining to Internal Revenue Service workers compensation issues may be directed to our Workers Compensation Center located in Richmond Virginia at 1-800-234-8323. Pre-tax deductions eg deferred compensation tax-sheltered annuities and healthdental premium co-pays revert to regular deductions from IDL or can be deducted from IDL. The IRS manual reads.

It doesnt matter if theyre receiving benefits for a slip and fall accident muscle strain back injury tendinitis or carpal tunnel. The subject of a Workers Comp tax comes up each year as today is the end of our tax filing season. Founded in 1912 and with assets under management of approximately 28 billion it is the largest state-operated provider of workers compensation insurance in the United States.

Are Workers Comp premiums a tax. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare 145 each plus an additional 09 withheld from the wages of an individual paid more than 200000 are set by the IRS. Employers generally are liable for both federal and Minnesota unemployment taxes.

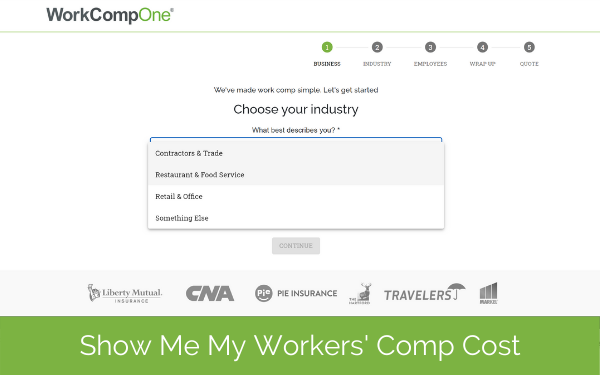

In most cases they wont pay taxes on workers comp benefits. As part of its survey EMPLOYERS asked small business owners to. These Days Most Workers Compensation Insurance Premiums Look Like Payroll Taxes Whether you pay Ohio BWC KEMI or popular private carriers like Travelers or Liberty Mutual one thing that is common across the board for work comp insurance is that your insurance premium looks more like a payroll tax then an insurance bill.

A credit of up to 54 percent may be allowed for state unemployment taxes paid for. 2022 Federal State Payroll Tax Rates for Employers. The federal unemployment tax rate is 62 percent of the first 7000 in wages paid each employee.

1099-G Tax Forms have been mailed to all claimants who received unemployment compensation in 2021. 3 hours agoWorkers compensation laws and regulations provide workers with periodic cash benefits and payment for medical treatment for diseases and injuries suffered while working. The following payments are not taxable.

From industry-specific safety training to individualized safety and health consulting services we offer numerous programs and initiatives specifically designed to protect your companys most valuable resource - its employees. If you get the full credit your net FUTA tax rate would be just 06 42 plus whatever you owe to your state government.

Pdf Hr For Small Business An Essential Guide For Managers Human Business Books Employee Handbook Human Resources

Ssd And Workers Compensation Benefits

Is Workers Comp Taxable Workers Comp Taxes

Get The Best Rates On Workers Compensation Insurance Workers Compensation Insurance Workers Comp Insurance Small Business Insurance

With Hundreds Of Peos Offering Thousands Of Different Service Options We Ll Talk About Getting Company Benefits Workers Compensation Insurance Risk Management

How Much Does An Employee Cost Infographic Patriot Software Entrepreneur Business Plan Accounting Education Budget Help

Costratesadvisor Com Payroll Analysis Report Workers Comp Insurance Analysis Payroll Taxes

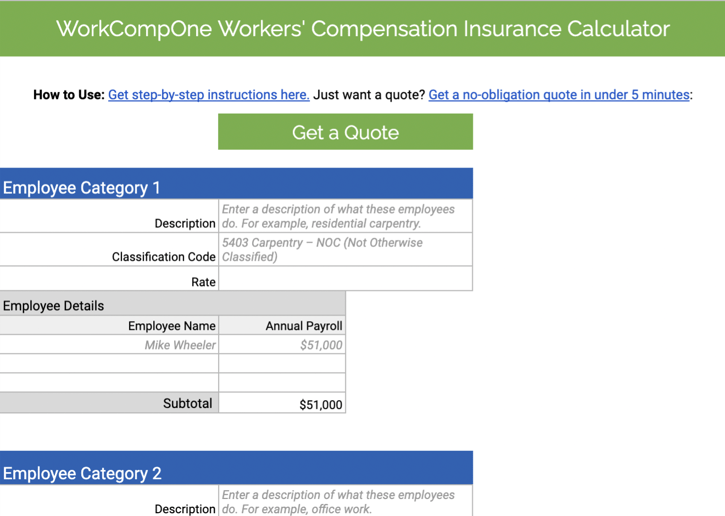

How To Calculate Workers Compensation Cost Per Employee

Workers Compensation Insurance Cost Calculator How Much For A Small Business Policy

Fmla Vs Workers Compensation Rules What No One Tells You

Workers Comp Vs Unemployment Benefits Foote Mielke Chavez O Neil

Are Workers Comp Benefits Adequate Legal Talk Network

Workers Compensation Insurance Overview Amtrust Financial

How To Calculate Workers Compensation Cost Per Employee Pie Insurance

Fica Taxes Unemployment Insurance Workers Comp For Owners

California Workers Comp Ebook Injured On The Job Take Charge Personal Injury Claims

What Is Pay As You Go Workers Comp